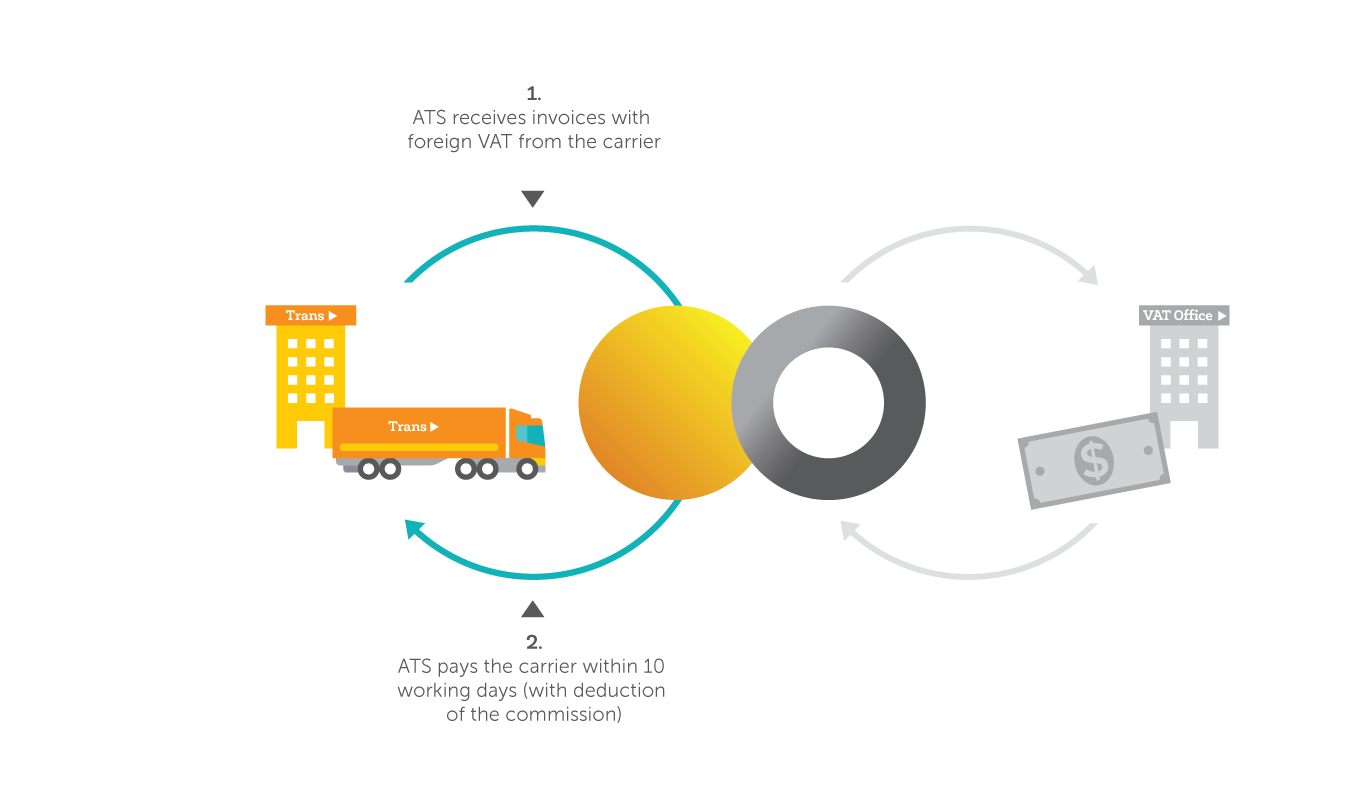

Pre-financing VAT

The recovery of VAT and excise duties has two main forms: with or without pre-financing. The difference is clear. Money in the account or trade receivables. Submitting claims is generally permitted once per quarter. The foreign tax authorities then need time. Per balance, a waiting period of 6 to 12 months is not exceptional.

Don’t feel like waiting so long for your own money? Then pre-financing offers a solution. The outstanding amount is transferred within a maximum of ten working days. This applies to all invoices submitted during the quarter. This is the added value of Net-invoicing or Fast Refund. Without pre-financing, there is a Normal Refund.

Whoever has a lot of vehicles on the road abroad will inevitably pay foreign VAT on fuel and tolls. It adds up. Recovery is possible, but it takes time. Per balance, a waiting period of 6 to 12 months is not exceptional. This directly affects liquidity and solvency.

Payment within a maximum of 10 working days

Alfa Transport Service improves liquidity and solvency. This is done by pre-financing foreign VAT and excise duty claims at a competitive rate. After receiving and checking the invoices, the outstanding amount will appear on the account of the carrier within a maximum of 10 working days. This happens once a quarter, once a month or, partly depending on the amount of the claimed amount, per invoice round. The choice is yours.

Pre-financing VAT

Innovative service provider

The intensive collaboration between the operational and IT department enables Alfa Transport Service to implement various working solutions for new applications. Everything is focused on optimising services to customers and partners.

Advantages

- Available starting from 1 vehicle

- Improved liquidity

- Improved solvency

- Fixed steady VAT payments

- Financing within 10 working days

- Competitive rates

- Clean bookkeeping

- Balance reduction

Track & tracing via online web portal

There is nothing as annoying and time-consuming as a ledger that doesn’t balance. That is why the online web portal is online 24/7 for track & tracing of progress. All invoices are available in real-time on screen as well as an overview per country of the amount and current status of all receivables.

With and without pre-financing

The recovery of VAT and excise duty has two main forms: with or without pre-financing. The difference is clear. Money in the account or trade receivables. Submitting claims is generally permitted once per quarter. The foreign tax authorities then need time. Per balance, a waiting period of 6 to 12 months is not exceptional.

Don’t feel like waiting so long? Then pre-financing offers a solution. The outstanding amount is transferred within a few days. This applies to all invoices submitted during the quarter. This is the added value of Net-invoicing or Fast Refund. Without pre-financing, there is a Normal Refund.

More Information? Feel free to contact us and feel the peace of security.